Home

Sr22 Insurance State Farm . Statefarm auto insurance has one of the widest coverage offerings in the industry, in every state i had state farm auto insurance for four years. How much does it cost?

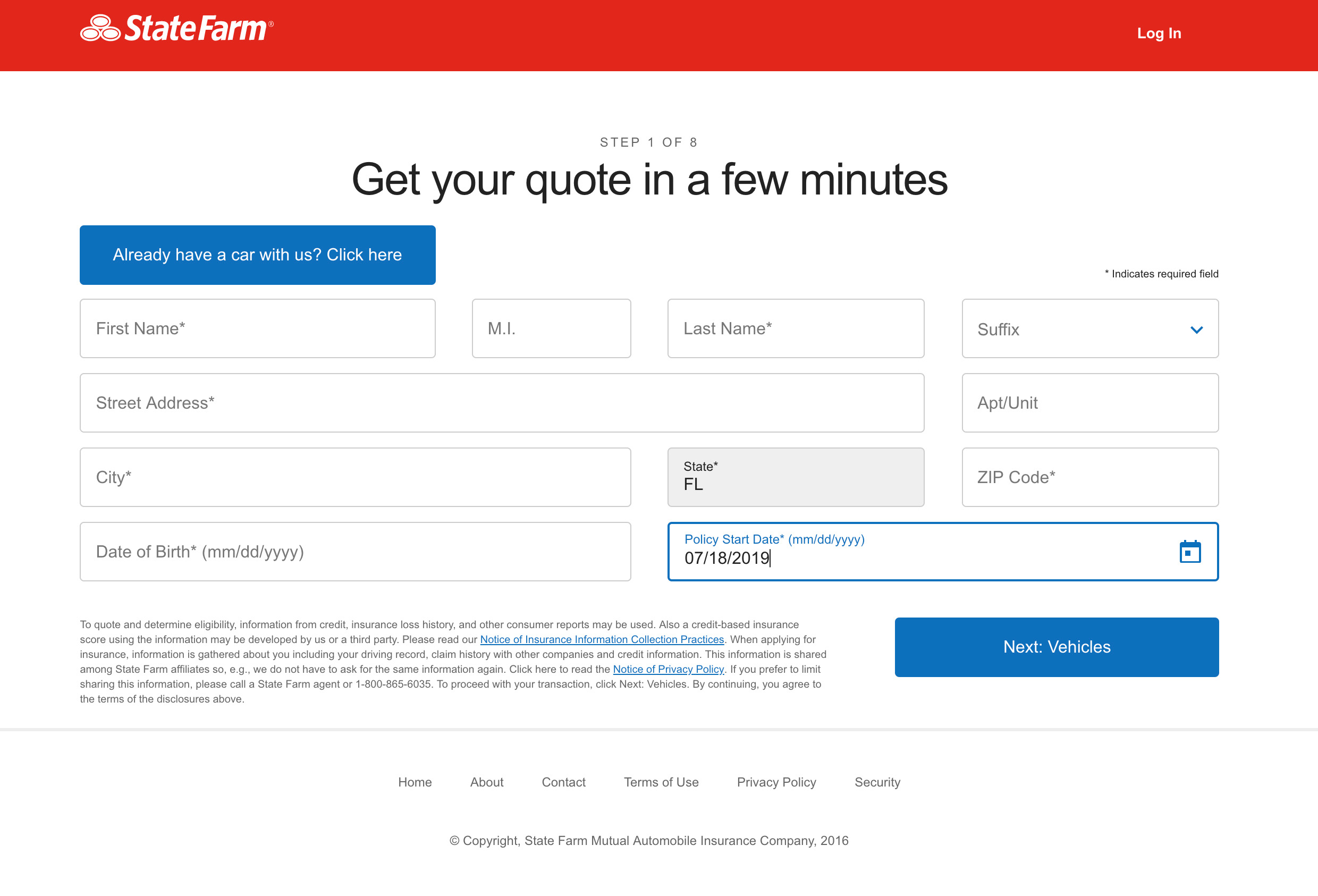

State Farm Auto Insurance Review 2021 Autoinsurance Org from www.autoinsurance.org Prices as low as $41/month. It's filed on your behalf by your insurance company and. Learn more about what sr22 car insurance is and who qualifies for sr22 insurance coverage. Get your free sr22 quote from our insurance experts today. So, it may be worthwhile investigating your own states laws and protocols.

But, it is a verification policy if you will. With either an sr22 or fr44, the car insurance company will make sure you buy the appropriate amount of coverage to comply with your mandated insurance requirements. Some states require proof of. So, it may be worthwhile investigating your own states laws and protocols. Sr22 insurance proves you have the minimum car insurance required in your state. However, you do not need to get disheartened as there are several insurance companies that specialize in. Also, be aware that your state, or insurer.

Source: honest-policy-assets.s3.amazonaws.com Prices as low as $41/month. Where do you get it? Many states require some drivers to file sr22 paperwork along with their car insurance. Car insurance with a dui is around $367 a month.

It is most often required after you get cited for driving without insurance, dui or other major traffic violations. Compare quotes from progressive, geico, the general, and more. It's filed on your behalf by your insurance company and. Knowing what sr22 insurance is and how to get it is the beginning of getting your driving privileges reinstated.

Sr22 insurance proves you have the minimum car insurance required in your state. But, it is a verification policy if you will. Prices as low as $41/month. It's filed on your behalf by your insurance company and.

Source: 2.bp.blogspot.com Some states require proof of. Knowing what sr22 insurance is and how to get it is the beginning of getting your driving privileges reinstated. However, you do not need to get disheartened as there are several insurance companies that specialize in. So, it may be worthwhile investigating your own states laws and protocols.

Many states require some drivers to file sr22 paperwork along with their car insurance. An sr22 certificate is a document that you or your insurance company files with the state. If these are higher than the limits you usually carry, then expect to pay more. Also, be aware that your state, or insurer.

The exceptions are alaska and mississippi, where they can range up to 5 years before expiry. Where do you get it? An sr22 certificate is a document that you or your insurance company files with the state. Learn more about what sr22 car insurance is and who qualifies for sr22 insurance coverage.

Source: www.investopedia.com Failure to have an sr22 certificate on file when mandated by the state could result in having your license suspended and losing your vehicle. So, there is really no difference between a regular insurance policy and. It's filed on your behalf by your insurance company and. How much does it cost?

Learn what it is, who needs it, and how much it costs. The form shows the state that you have minimum liability limits for auto insurance. However, you do not need to get disheartened as there are several insurance companies that specialize in. Also, be aware that your state, or insurer.

It is most often required after you get cited for driving without insurance, dui or other major traffic violations. The sr22 is not a type of auto insurance per se. Learn more about what sr22 car insurance is and who qualifies for sr22 insurance coverage. Car insurance with a dui is around $367 a month.

Source: truckcamperhints.files.wordpress.com It is most often required after you get cited for driving without insurance, dui or other major traffic violations. Learn more about what sr22 car insurance is and who qualifies for sr22 insurance coverage. How much does it cost? So, there is really no difference between a regular insurance policy and.

Also, be aware that your state, or insurer. With either an sr22 or fr44, the car insurance company will make sure you buy the appropriate amount of coverage to comply with your mandated insurance requirements. Learn what it is, who needs it, and how much it costs. The form shows the state that you have minimum liability limits for auto insurance.

It is most often required after you get cited for driving without insurance, dui or other major traffic violations. So, it may be worthwhile investigating your own states laws and protocols. An sr22 certificate is a document that you or your insurance company files with the state. The exceptions are alaska and mississippi, where they can range up to 5 years before expiry.

Source: www.markslocksmith.com The form shows the state that you have minimum liability limits for auto insurance. So buying an insurance policy becomes more expensive than if you had a clean record. Many states require some drivers to file sr22 paperwork along with their car insurance. Sr22 insurance is just regular car insurance with a certificate of financial responsibility filing added.

If these are higher than the limits you usually carry, then expect to pay more. Get your free sr22 quote from our insurance experts today. How much does it cost? So, there is really no difference between a regular insurance policy and.

However, you do not need to get disheartened as there are several insurance companies that specialize in. Some states require proof of. Learn what it is, who needs it, and how much it costs. It is most often required after you get cited for driving without insurance, dui or other major traffic violations.

Thank you for reading about Sr22 Insurance State Farm , I hope this article is useful. For more useful information visit https://jdvintagecars.com/